Introduction

Navigating the US stock market can be daunting for beginners, but understanding the index is crucial for making informed investment decisions. The index of the US stock market serves as a barometer of the overall market's health and direction. This article delves into the key aspects of the US stock market index, providing investors with valuable insights to guide their investments.

The S&P 500 Index

One of the most widely followed stock market indices is the S&P 500. It represents the top 500 companies by market capitalization and includes a diverse range of industries. The S&P 500 is often considered a proxy for the broader market and is used to gauge the overall performance of the US stock market.

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average is another significant index that tracks the performance of 30 large, publicly-owned companies in the United States. These companies represent various industries and are selected by editors at Dow Jones & Company. The DJIA is known for its historical significance and is often used as a benchmark for the stock market's performance.

NASDAQ Composite Index

The NASDAQ Composite Index is a broad-based index that tracks all domestic and international common stocks listed on the NASDAQ Stock Market. It includes more technology companies than other indices, making it a popular choice for investors interested in tech stocks.

Understanding Index Components

Each index has its own set of components, which are the individual stocks that make up the index. These components are chosen based on various criteria, such as market capitalization, industry representation, and liquidity.

For example, the S&P 500 includes companies from sectors such as technology, healthcare, financials, and consumer goods. The DJIA includes companies from industries such as transportation, energy, and consumer goods. The NASDAQ Composite includes a wide range of technology companies, as well as biotechnology and telecommunications companies.

Interpreting Index Movements

The movement of the index can provide valuable insights into the overall market's direction. A rising index suggests that the market is performing well, while a falling index indicates a negative market trend.

Impact on Investors

Understanding the index of the US stock market is crucial for investors as it helps them gauge the market's performance and make informed decisions. Investors can use the index to:

- Assess the overall market's health and direction.

- Identify trends and opportunities.

- Determine the risk level of their investments.

Case Study: The 2020 Stock Market Crash

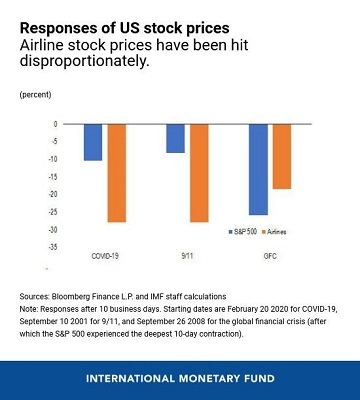

One notable example of how the index of the US stock market can impact investors is the 2020 stock market crash. In March 2020, the stock market experienced a rapid decline due to the COVID-19 pandemic. The S&P 500 and other indices fell significantly, reflecting the widespread market downturn. Investors who were well-informed about the index were better equipped to make informed decisions and protect their investments during this turbulent period.

Conclusion

Understanding the index of the US stock market is essential for investors who want to make informed decisions and navigate the market effectively. By familiarizing themselves with key indices such as the S&P 500, DJIA, and NASDAQ Composite, investors can gain valuable insights into the market's performance and direction. By staying informed and staying focused on the indices, investors can position themselves for success in the US stock market.

us stock market today live cha