The ongoing US-China trade war has been a topic of intense scrutiny and speculation across financial markets. This article delves into the profound impact of the trade tensions on the stock market, exploring both the immediate effects and the long-term implications.

Understanding the Trade War Dynamics

The trade war between the US and China began in 2018, sparked by President Donald Trump's administration imposing tariffs on Chinese goods. China retaliated with its own tariffs on American products. This tit-for-tat exchange has created uncertainty and volatility in the global markets, especially the stock market.

Immediate Stock Market Reactions

Impact on Technology Stocks

Technology stocks have been particularly affected by the trade war. Many technology companies have significant operations in China, and the imposition of tariffs has increased their costs. As a result, tech giants like Apple, Micron, and Qualcomm have seen their stocks fluctuate dramatically.

Volatility in the Stock Market

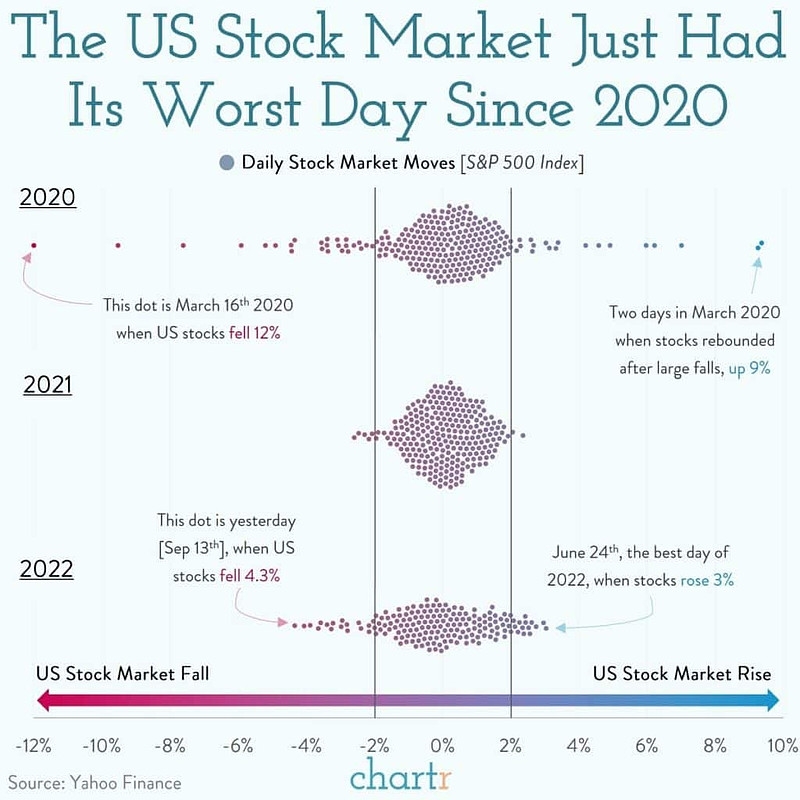

The trade war has introduced a significant amount of volatility into the stock market. This volatility is reflected in the stock indices, with the S&P 500 and the NASDAQ experiencing sharp swings. Investors have become increasingly cautious, leading to sell-offs and buybacks in quick succession.

Long-Term Implications

Economic Slowdown Concerns

The trade war has raised concerns about an economic slowdown. As the world's two largest economies, any disruption in trade between the US and China can have far-reaching effects on the global economy. This has led to a cautious stance among investors, with many focusing on defensive stocks.

Investment Opportunities in China

Despite the trade war, some investors are seeing opportunities in the Chinese market. Companies that have a strong presence in China or are looking to expand into the country may benefit from the growing middle class and the increasing demand for goods and services.

Case Studies

Apple's Stock Performance

One of the most notable examples of the trade war's impact is Apple Inc. The company has faced increased production costs due to the tariffs imposed on Chinese imports. Despite this, Apple's stock has remained relatively stable, largely due to its diverse product line and strong brand loyalty.

Tesla's China Operations

Tesla Inc., another major US company with significant operations in China, has also been affected by the trade war. However, the company has taken steps to mitigate the impact, including localizing production and sourcing components from within China.

Conclusion

The US-China trade war has undoubtedly had a significant impact on the stock market. While the immediate effects have been volatile, the long-term implications are still unfolding. Investors need to remain vigilant and adaptable as the trade tensions continue to evolve.

us stock market today live cha