As the week draws to a close, investors are keeping a close eye on the Dow futures for Friday. This article will delve into the latest predictions, insights, and factors that could impact the market's trajectory. Whether you're a seasoned trader or just dipping your toes into the world of futures, this guide will provide you with the information you need to stay ahead of the curve.

Understanding Dow Futures

Before diving into the predictions, let's take a moment to understand what Dow futures are. Dow futures are financial contracts that allow investors to speculate on the future price of the Dow Jones Industrial Average (DJIA). The DJIA is a stock market index that tracks the performance of 30 large companies listed on the New York Stock Exchange (NYSE) and the NASDAQ.

Key Predictions for Friday

Several factors are contributing to the predictions for Dow futures for Friday. Here are some of the key factors to consider:

Economic Data: Economic reports, such as GDP growth, unemployment rates, and inflation data, can significantly impact the market's trajectory. Traders will be closely monitoring these reports to gauge the overall health of the economy.

Global Events: Geopolitical tensions, such as trade disputes or political instability, can lead to market volatility. Investors will be keeping an eye on global events to assess any potential risks.

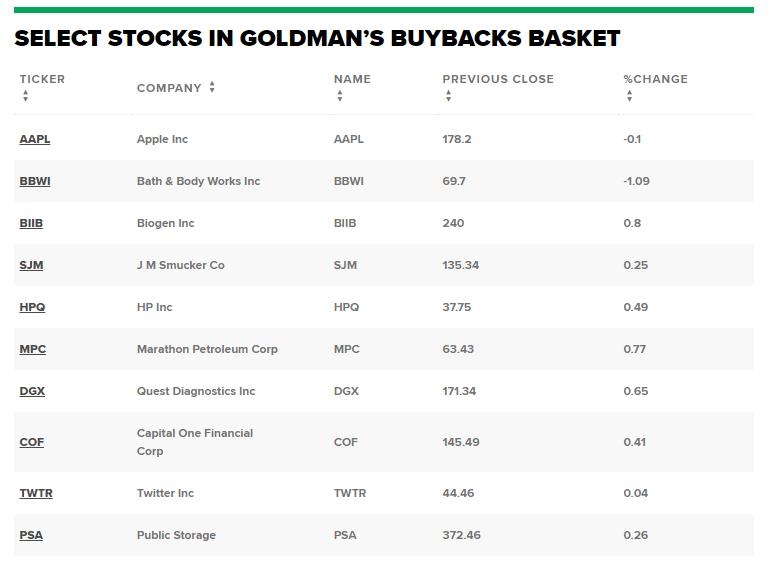

Company Earnings: Corporate earnings reports can provide valuable insights into the financial health of companies within the DJIA. Traders will be analyzing these reports to identify potential winners and losers in the market.

Market Sentiment: The overall mood of the market can influence the direction of Dow futures. Factors such as consumer confidence, investor sentiment, and economic outlook can all play a role in shaping market sentiment.

Insights into Friday's Potential Moves

Based on the above factors, here are some insights into the potential moves for Dow futures for Friday:

- Positive Economic Data: If economic reports show strong growth and low inflation, it could boost investor confidence and drive the market higher.

- Global Tensions: If geopolitical tensions escalate, it could lead to market volatility and a potential decline in Dow futures.

- Strong Company Earnings: If companies within the DJIA report strong earnings, it could boost investor confidence and drive the market higher.

- Market Sentiment: If market sentiment remains positive, it could lead to higher Dow futures.

Case Study: Dow Futures in the Wake of the COVID-19 Pandemic

One notable example of how Dow futures can be impacted by external factors is the COVID-19 pandemic. In early 2020, as the pandemic began to spread, Dow futures experienced significant volatility. However, as governments around the world implemented stimulus measures and companies adapted to the new normal, the market began to recover.

This case study highlights the importance of staying informed and adaptable when trading Dow futures.

Conclusion

In conclusion, Dow futures for Friday will be influenced by a variety of factors, including economic data, global events, company earnings, and market sentiment. By understanding these factors and staying informed, investors can better navigate the potential moves in the market. As always, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions.

us stock market today live cha