Embarking on the journey to construct a diversified US stock market portfolio can be daunting. However, Exchange Traded Funds (ETFs) have revolutionized the way investors can achieve this goal. By providing a cost-effective, transparent, and tax-efficient means of investing, ETFs have become a cornerstone of modern investment strategies. This article delves into the key aspects of constructing a US stock market portfolio using ETFs, offering insights and practical tips to help you get started.

Understanding ETFs

Firstly, it's essential to understand what ETFs are. An ETF is a type of exchange-traded fund that tracks a specific index, such as the S&P 500 or the NASDAQ 100. Unlike traditional mutual funds, ETFs trade on exchanges like stocks, allowing investors to buy and sell shares throughout the trading day at market prices.

Diversification with ETFs

One of the primary advantages of using ETFs to construct a stock market portfolio is diversification. By investing in a single ETF, you gain exposure to a wide array of stocks within a specific sector or market index. This diversification helps to reduce risk by spreading your investments across various companies and industries.

Choosing the Right ETFs

When constructing your US stock market portfolio, it's crucial to choose the right ETFs. Consider the following factors:

- Investment Strategy: Determine your investment strategy, whether it's growth, income, or balanced. This will help you select ETFs that align with your goals.

- Expense Ratio: Look for ETFs with a low expense ratio, as this will minimize the impact on your returns.

- Dividends: If you're seeking income, consider ETFs that focus on dividend-paying stocks.

- Liquidity: Choose ETFs with high liquidity to ensure you can buy and sell shares easily.

Case Study: Vanguard S&P 500 ETF (VOO)

One popular ETF for constructing a US stock market portfolio is the Vanguard S&P 500 ETF (VOO). This ETF tracks the performance of the S&P 500, which represents the 500 largest companies listed on US exchanges. By investing in VOO, you gain exposure to a diverse range of industries and companies, providing a solid foundation for your portfolio.

Balancing Your Portfolio

To achieve a well-balanced portfolio, consider allocating your investments across various asset classes, including stocks, bonds, and cash. Within the stock portion of your portfolio, use ETFs to diversify your investments across different sectors and market capitalizations.

Monitoring and Rebalancing

Once you've constructed your US stock market portfolio using ETFs, it's essential to monitor its performance and rebalance as needed. This involves adjusting your asset allocation to maintain the desired balance between risk and return.

Conclusion

Constructing a US stock market portfolio using ETFs can be a powerful way to achieve diversification, cost-effectiveness, and tax efficiency. By understanding the basics of ETFs, choosing the right ETFs, and monitoring your portfolio, you can build a robust investment strategy that aligns with your financial goals.

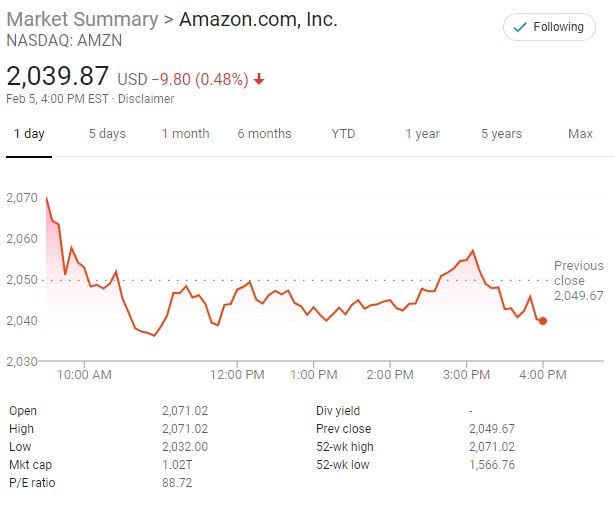

us stock market today live cha