Introduction:

Understanding market indicators is crucial for any investor looking to make informed decisions. Whether you are a seasoned trader or a beginner, having a solid grasp of market indices can significantly impact your financial success. This comprehensive guide will delve into the world of market indicators, highlighting key concepts, strategies, and practical insights. So, let’s dive in and discover how to harness the power of market indices.

Understanding Market Indicators:

Market indicators are tools used to analyze financial markets and predict future movements. They are typically derived from various factors such as economic data, stock prices, and other relevant information. Some of the most popular market indicators include:

Stock Indices: Stock indices, such as the S&P 500, NASDAQ Composite, and DJIA, provide a snapshot of the overall market performance. By tracking these indices, investors can gain insights into market trends and identify potential opportunities.

Bond Yields: Bond yields indicate the interest rates that investors can earn by purchasing bonds. By analyzing bond yields, investors can gauge the overall economic outlook and identify favorable investment opportunities.

Consumer Confidence Index: This index measures the level of consumer confidence in the economy. A higher index suggests that consumers are optimistic about the future, which can positively impact the stock market.

GDP Growth Rate: GDP growth rate is a measure of a country’s economic health. Higher GDP growth rates generally indicate a strong economy, which can lead to increased investment opportunities.

Inflation Rate: The inflation rate reflects the rate at which the general level of prices for goods and services is rising. Understanding inflation is crucial for making investment decisions, as it can affect the purchasing power of your investments.

Strategies for Using Market Indicators:

Now that we have a basic understanding of market indicators, let’s explore some strategies for effectively utilizing these tools:

Long-term Trend Analysis: Analyzing long-term trends can help investors identify potential buy and sell points. For example, if a stock index has been consistently rising over the past few years, it may be a good opportunity to invest.

Divergence Analysis: Divergence occurs when market indicators provide conflicting signals. By identifying divergences, investors can anticipate potential market movements and adjust their strategies accordingly.

Cross-asset Class Analysis: Comparing different market indicators across asset classes can provide a more comprehensive view of the market. For instance, analyzing the correlation between stock indices and bond yields can offer valuable insights into market conditions.

Sentiment Analysis: Sentiment indicators, such as the put/call ratio, can help investors gauge the overall market sentiment. By understanding market sentiment, investors can make more informed decisions about when to enter or exit the market.

Fundamental Analysis: While market indicators provide valuable insights, it is also essential to conduct fundamental analysis. This involves researching individual companies and assessing their financial health, industry position, and growth prospects.

Case Study: The 2020 Stock Market Crash

A prime example of the importance of market indicators is the 2020 stock market crash. In early 2020, the S&P 500 and other major indices experienced a rapid decline due to the COVID-19 pandemic. Investors who monitored market indicators and sentiment, such as the consumer confidence index, were able to anticipate the market’s decline and adjust their strategies accordingly.

Conclusion:

Market indicators are essential tools for investors looking to make informed decisions. By understanding and utilizing these indicators effectively, investors can gain a competitive edge in the market. Remember, a comprehensive approach that combines market indicators, strategies, and fundamental analysis is key to long-term success.

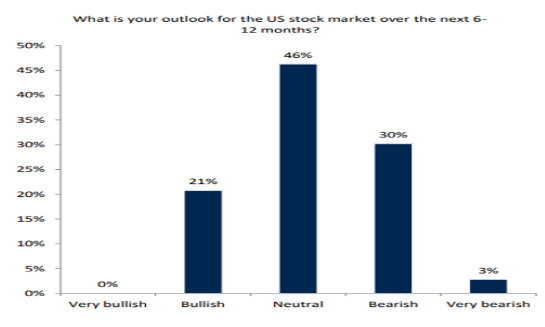

us stock market today