In the world of finance, the term "pre-stock price" is a crucial concept for investors and traders. It refers to the price of a stock before it opens for trading on the stock exchange. Understanding this price can help you make informed decisions about buying or selling stocks. This article delves into the significance of pre-stock prices, how they are determined, and their impact on your investment strategy.

What is a Pre-Stock Price?

The pre-stock price is the estimated value of a stock before it begins trading on the market. This price is often based on a variety of factors, including market sentiment, company news, and technical analysis. It's important to note that the pre-stock price is not a guaranteed price at which the stock will trade, but rather an estimate.

Factors Influencing Pre-Stock Prices

Several factors can influence the pre-stock price of a company. Here are some of the key factors:

- Market Sentiment: The overall mood of the market can significantly impact pre-stock prices. If investors are optimistic about the market, pre-stock prices may be higher. Conversely, if there is widespread pessimism, pre-stock prices may be lower.

- Company News: Any significant news about a company, such as earnings reports, product launches, or management changes, can impact its pre-stock price.

- Economic Indicators: Economic indicators, such as GDP growth, unemployment rates, and inflation, can also influence pre-stock prices.

- Technical Analysis: Technical analysts use historical price and volume data to predict future price movements. Their analysis can also impact pre-stock prices.

How to Find Pre-Stock Prices

To find pre-stock prices, you can use a variety of resources, including financial news websites, stock market apps, and brokerage platforms. Many of these resources provide pre-market trading data, which can help you make informed decisions about your investments.

The Impact of Pre-Stock Prices on Your Investment Strategy

Understanding pre-stock prices can help you develop a more effective investment strategy. Here are some ways pre-stock prices can impact your strategy:

- Identifying Opportunities: By analyzing pre-stock prices, you can identify potential opportunities to buy or sell stocks.

- Risk Management: Pre-stock prices can help you assess the risk associated with a particular stock.

- Market Timing: Some investors use pre-stock prices to time their market entries and exits.

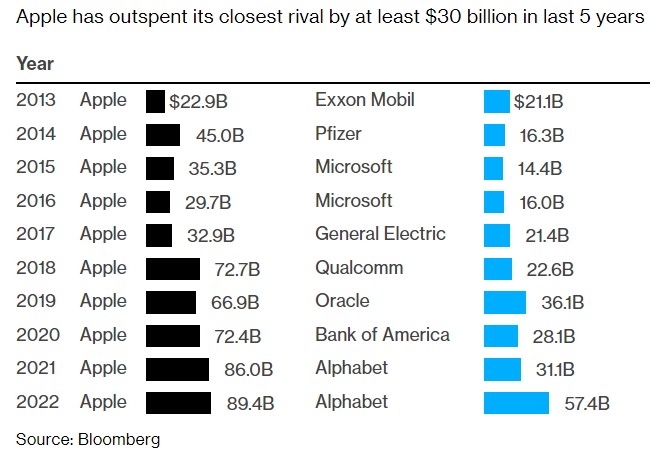

Case Study: Apple's Pre-Stock Price

Let's consider a case study involving Apple Inc. (AAPL). In the days leading up to Apple's quarterly earnings report, the pre-stock price for AAPL was around

Conclusion

Understanding the pre-stock price is an essential part of successful stock market investing. By analyzing the factors that influence pre-stock prices and incorporating them into your investment strategy, you can make more informed decisions and potentially improve your investment returns.

us flag stock