As we delve into the current US stock market outlook for July 2025, it's essential to understand the factors that are shaping this dynamic landscape. The stock market is a reflection of the broader economic conditions, investor sentiment, and corporate performance. This analysis will explore the key trends, potential risks, and opportunities that investors should be aware of.

Economic Indicators and Trends

The US economy has shown remarkable resilience over the past few years, with steady growth and low unemployment rates. However, there are several economic indicators that investors should keep an eye on:

- Inflation: Inflation has been a significant concern for investors in recent years. While the Federal Reserve has taken measures to control inflation, it remains a key factor to watch in the stock market.

- Interest Rates: The Federal Reserve's monetary policy decisions regarding interest rates can have a significant impact on the stock market. Higher interest rates can lead to increased borrowing costs for companies, which can negatively impact their profitability.

- GDP Growth: The growth rate of the US GDP is a crucial indicator of the overall economic health. A strong GDP growth rate can indicate a healthy stock market, while a slowdown can signal potential risks.

Sector Performance

Different sectors within the stock market have shown varying levels of performance. Here are some key sectors to watch:

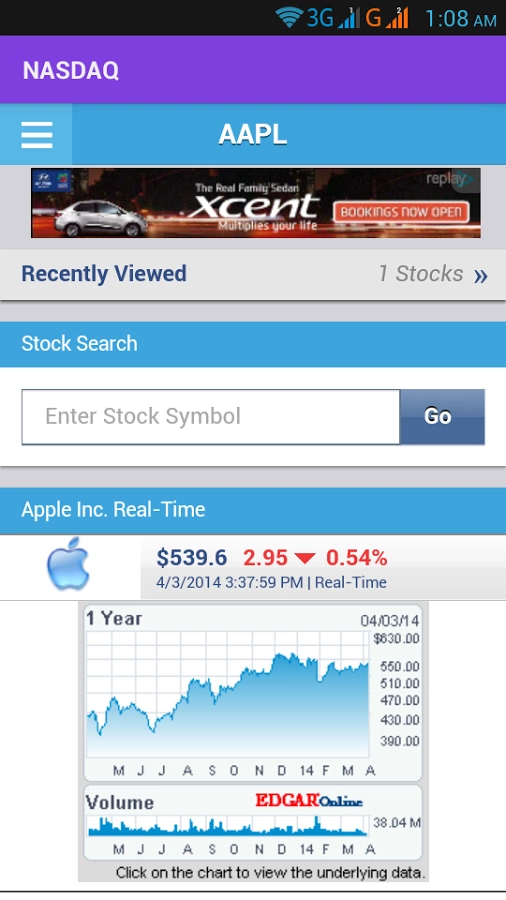

- Technology: The technology sector has been a major driver of the stock market's growth over the past few years. Companies like Apple, Microsoft, and Amazon have seen significant gains. However, there are concerns about valuations and potential regulatory challenges.

- Healthcare: The healthcare sector has been a stable performer, driven by the aging population and increasing demand for healthcare services. Companies like Johnson & Johnson and Pfizer have seen steady growth.

- Energy: The energy sector has seen a surge in recent years, driven by the rise in oil prices. Companies like ExxonMobil and Chevron have seen significant gains. However, there are concerns about the impact of climate change and the transition to renewable energy.

Market Risks and Opportunities

While there are several opportunities in the stock market, there are also potential risks that investors should be aware of:

- Market Volatility: The stock market can be highly volatile, with sharp ups and downs. Investors should be prepared for potential market corrections.

- Geopolitical Risks: Global geopolitical tensions can impact the stock market. Investors should be aware of potential risks such as trade wars and geopolitical conflicts.

- Technological Disruption: Rapid technological advancements can disrupt traditional industries and impact the stock market. Investors should stay informed about emerging technologies and their potential impact on various sectors.

Case Studies

To illustrate the potential risks and opportunities in the stock market, let's consider a few case studies:

- Tesla: Tesla has been a major success story in the technology sector, with significant growth in its stock price. However, the company has faced challenges related to production issues and regulatory concerns.

- Amazon: Amazon has been a dominant player in the e-commerce sector, with significant growth in its stock price. However, the company has faced criticism regarding its labor practices and environmental impact.

- ExxonMobil: ExxonMobil has been a stable performer in the energy sector, with steady growth in its stock price. However, the company has faced challenges related to the transition to renewable energy.

In conclusion, the current US stock market outlook for July 2025 presents both opportunities and risks. Investors should stay informed about economic indicators, sector performance, and potential risks to make informed investment decisions.

us flag stock