As we delve into the summer of 2025, the US stock market finds itself at a pivotal point. This article aims to provide a comprehensive analysis of the current conditions, highlighting key trends, sectors, and potential risks. By understanding the market's current state, investors can make informed decisions and navigate the complexities of the financial landscape.

Market Overview

The US stock market has experienced a rollercoaster ride over the past few years, with numerous ups and downs. As of July 2025, the market is showing signs of stabilization, but it's crucial to recognize that volatility remains a constant factor. The S&P 500, a widely followed index, reflects the overall performance of the market and has been fluctuating within a relatively narrow range.

Trends to Watch

Technology Sector: The technology sector has been a significant driver of market growth, with companies like Apple, Microsoft, and Amazon leading the charge. However, concerns about rising inflation and increased regulatory scrutiny have caused some uncertainty in this sector.

Energy Sector: The energy sector has seen a surge in recent months, driven by rising oil prices and increased demand for energy resources. Companies in this sector, such as ExxonMobil and Chevron, have seen their stock prices soar.

Healthcare Sector: The healthcare sector has been a stable performer, with companies like Johnson & Johnson and Pfizer showing resilience. The increasing focus on biotechnology and pharmaceuticals has also contributed to this sector's growth.

Sector Analysis: Technology

The technology sector has been a major force in the US stock market, with companies like Apple, Microsoft, and Amazon leading the charge. However, recent concerns about rising inflation and increased regulatory scrutiny have caused some uncertainty in this sector.

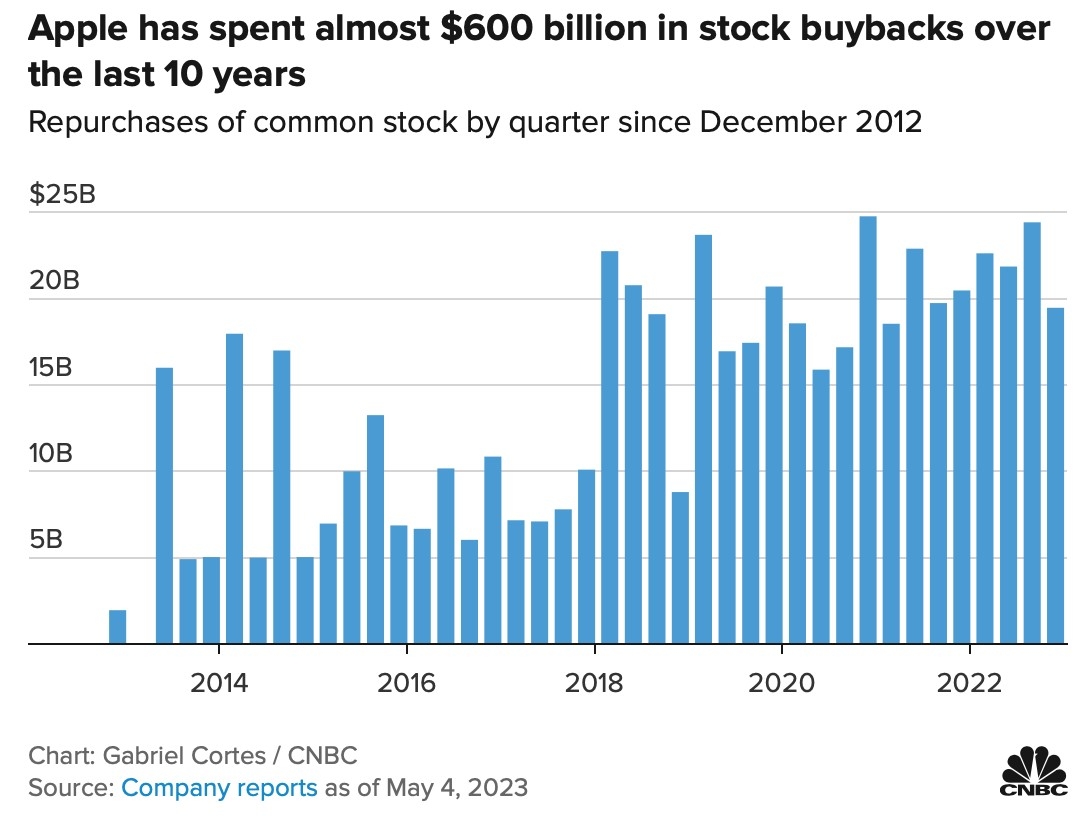

Apple: As the world's largest technology company, Apple has been a key driver of market growth. Its products, including the iPhone, iPad, and Mac, have been highly successful, and the company's services division has also seen significant growth.

Microsoft: Microsoft has been a dominant player in the technology sector, with its products and services being widely used in both consumer and enterprise markets. The company's cloud computing business, Azure, has been a significant contributor to its growth.

Amazon: Amazon has revolutionized the retail industry with its e-commerce platform and has expanded into various other sectors, including cloud computing, streaming, and logistics. The company's market capitalization has soared, making it one of the most valuable companies in the world.

Risks and Challenges

Despite the positive trends, the US stock market faces several risks and challenges. These include:

Inflation: Rising inflation has been a major concern for investors, as it can erode purchasing power and impact corporate profits.

Regulatory Scrutiny: Increased regulatory scrutiny in various sectors, particularly technology, has raised concerns about potential restrictions on business operations.

Global Economic Uncertainty: The global economy remains uncertain, with concerns about trade tensions, geopolitical conflicts, and economic slowdowns in key regions.

Conclusion

The US stock market, as of July 2025, finds itself at a critical juncture. While there are several positive trends, investors must remain vigilant about the risks and challenges that lie ahead. By staying informed and making informed decisions, investors can navigate the complexities of the financial landscape and achieve their investment goals.

us flag stock