Are you a Thai investor looking to diversify your portfolio by investing in US stocks? If so, you've come to the right place. This comprehensive guide will walk you through the process of buying US stocks from Thailand, ensuring you make informed decisions and maximize your investment potential.

Understanding the Basics

Before diving into the process, it's crucial to understand the basics of buying US stocks. Unlike local stocks, US stocks are traded on American stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a wide range of investment opportunities, including blue-chip companies, emerging growth stocks, and everything in between.

Choosing a Broker

The first step in buying US stocks from Thailand is to choose a reliable brokerage firm. Several reputable brokers offer services to Thai investors, including TD Ameritrade, E*TRADE, and Charles Schwab. When selecting a broker, consider factors such as fees, customer service, and available investment options.

Opening an Account

Once you've chosen a broker, you'll need to open an account. The process typically involves providing personal information, proof of identity, and proof of address. Some brokers may also require a minimum deposit to open an account.

Understanding the Risks

It's important to understand the risks associated with investing in US stocks. The stock market can be volatile, and investing in foreign stocks may come with additional risks, such as currency exchange rates and political instability. Before investing, conduct thorough research and consider your risk tolerance.

Researching Stocks

To make informed investment decisions, it's crucial to research potential stocks. Look for companies with strong fundamentals, such as a solid financial track record, a competitive advantage, and a strong management team. You can use various resources, including financial news websites, stock analysis tools, and social media platforms, to gather information.

Placing an Order

Once you've identified a stock you want to buy, you'll need to place an order with your broker. You can do this through your online brokerage account or by contacting your broker directly. When placing an order, specify the number of shares you want to buy and the price you're willing to pay.

Monitoring Your Investments

After purchasing US stocks, it's essential to monitor your investments regularly. Keep an eye on the company's financial performance, industry trends, and market conditions. This will help you make informed decisions about when to buy, sell, or hold your investments.

Tax Considerations

When investing in US stocks from Thailand, it's important to understand the tax implications. Thai investors are subject to capital gains tax on profits from US stock investments. Be sure to consult with a tax professional to ensure you comply with all applicable tax laws.

Case Study: Investing in Apple (AAPL)

Let's say you're interested in investing in Apple Inc. (AAPL), a leading technology company with a strong track record. After conducting thorough research, you decide to buy 100 shares of AAPL at

This example demonstrates the potential for growth and profit when investing in US stocks. However, it's important to note that past performance is not indicative of future results.

Conclusion

Buying US stocks from Thailand can be a lucrative investment opportunity. By following this comprehensive guide, you can navigate the process and make informed investment decisions. Remember to conduct thorough research, choose a reliable broker, and monitor your investments regularly. Happy investing!

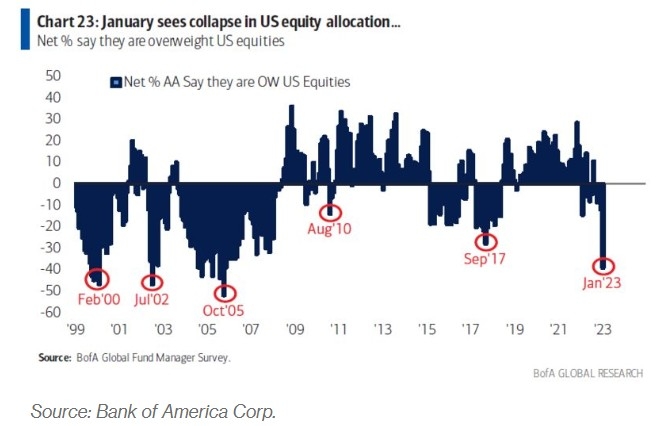

stock levels