In today's fast-paced financial world, investors are always looking for ways to maximize their returns. One such method is engaging in after-hour trades on the NASDAQ. These trades occur outside of regular market hours, offering unique opportunities for investors to capitalize on market movements and make informed decisions. This article delves into the world of after-hour trades on NASDAQ, exploring their benefits, risks, and how to make the most out of them.

Understanding After-Hour Trades on NASDAQ

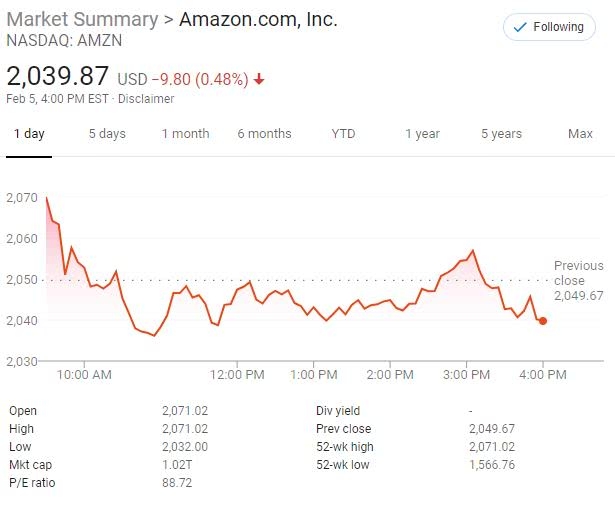

After-hour trades on NASDAQ refer to buying or selling stocks, ETFs, and other securities outside of the regular trading hours, which typically end at 4:00 PM Eastern Time. These extended hours provide investors with the flexibility to trade at their convenience, whether it's due to time zone differences, work commitments, or simply a desire to stay ahead of the market.

Benefits of After-Hour Trades on NASDAQ

- Access to Global Markets: After-hour trades on NASDAQ allow investors to participate in global markets, taking advantage of price movements in other regions that may occur during non-U.S. trading hours.

- Quick Reaction to News: Investors can react quickly to significant news events or earnings reports that occur after the regular market closes. This can lead to better decision-making and potentially higher returns.

- Increased Liquidity: Many investors prefer to trade during after-hours, which can lead to increased liquidity and tighter bid-ask spreads.

- No Slippage: With the ability to place orders before the market opens, investors can avoid slippage, which is the difference between the expected price of a trade and the price at which the trade is executed.

Risks of After-Hour Trades on NASDAQ

While after-hour trades on NASDAQ offer numerous benefits, they also come with their own set of risks:

- Market Volatility: The after-hours market can be more volatile due to less liquidity and a smaller number of participants.

- Potential for False Information: Investors must be cautious of false or misleading information that can spread quickly during after-hours trading.

- Lack of Regulation: The after-hours market is less regulated than the regular market, which can increase the risk of fraudulent activity.

How to Make the Most Out of After-Hour Trades on NASDAQ

- Stay Informed: Keep up with market news and earnings reports to make informed decisions during after-hours trading.

- Use Reliable Platforms: Choose a reputable brokerage firm that offers reliable after-hours trading platforms.

- Set Realistic Goals: Understand that after-hours trading can be riskier, so set realistic goals and avoid taking on excessive risk.

- Monitor Your Investments: Keep a close eye on your investments during after-hours trading to react quickly to any market movements.

Case Study: Apple's After-Hour Earnings Report

A prime example of the impact of after-hour trades on NASDAQ is Apple's earnings report. On April 30, 2020, Apple released its earnings report after the regular market closed. The report showed strong earnings and revenue growth, which led to a significant increase in the stock price during after-hours trading. Investors who were able to react quickly to this news were able to capitalize on the price increase.

In conclusion, after-hour trades on NASDAQ offer unique opportunities for investors to maximize their returns. By understanding the benefits and risks, and taking the necessary precautions, investors can make informed decisions and potentially benefit from market movements during non-traditional trading hours.

stock levels