Are you a Canadian citizen looking to diversify your investment portfolio? Investing in U.S. stocks can be an attractive option, but you might be wondering, "Can Canadian citizens buy US stocks?" The answer is yes, they can, but there are some important factors to consider. In this article, we'll explore the process, the benefits, and the potential risks of investing in U.S. stocks as a Canadian citizen.

Understanding the Process

1. Open a Brokerage Account

The first step is to open a brokerage account. This can be done with a Canadian or U.S. brokerage firm. Canadian citizens can open accounts with U.S. brokers, but they may need to provide additional documentation, such as a tax identification number (TIN) or a social security number (SSN).

2. Fund Your Account

Once your account is open, you'll need to fund it. You can transfer funds from your Canadian bank account or use other methods, such as credit cards or wire transfers.

3. Research and Invest

With your account funded, you can start researching and investing in U.S. stocks. Many Canadian investors use online platforms to research and trade stocks, making it easy to access a wide range of U.S. companies.

Benefits of Investing in U.S. Stocks

1. Diversification

Investing in U.S. stocks can help diversify your portfolio, reducing your exposure to the Canadian market. This can be particularly beneficial during times of economic uncertainty.

2. Access to Large, Established Companies

The U.S. stock market is home to many of the world's largest and most successful companies. By investing in U.S. stocks, you can gain exposure to these companies and potentially benefit from their growth.

3. Potential for Higher Returns

Historically, the U.S. stock market has offered higher returns than the Canadian market. This can be due to a variety of factors, including higher economic growth and more innovative companies.

Risks to Consider

1. Currency Fluctuations

Investing in U.S. stocks means you'll be exposed to currency fluctuations. If the Canadian dollar strengthens against the U.S. dollar, your returns in Canadian dollars may be reduced.

2. Tax Implications

Canadian citizens who invest in U.S. stocks need to be aware of the tax implications. While the U.S. does not tax Canadian citizens on their investment income, there may be tax implications when selling U.S. stocks.

3. Market Volatility

The U.S. stock market can be volatile, and investing in individual stocks carries a level of risk. It's important to do thorough research and consider your risk tolerance before investing.

Case Study: Investing in Apple as a Canadian Citizen

Let's consider a hypothetical scenario where a Canadian citizen decides to invest in Apple Inc. (AAPL), one of the world's largest and most valuable companies.

1. Research and Analysis

The investor conducts thorough research on Apple's financials, market position, and future growth prospects. They determine that Apple is a solid investment based on its strong fundamentals and growth potential.

2. Investment

The investor uses their brokerage account to purchase shares of Apple. They decide to invest $10,000, which is equivalent to approximately CAD 12,000 at the current exchange rate.

3. Monitoring and Adjusting

The investor monitors Apple's stock performance and adjusts their investment strategy as needed. They may decide to buy more shares if the stock price falls, or sell some shares if the stock price rises significantly.

By following these steps, the Canadian investor can potentially benefit from the growth of one of the world's most successful companies.

In conclusion, Canadian citizens can indeed buy U.S. stocks, but it's important to understand the process, benefits, and risks involved. With careful research and a well-diversified portfolio, investing in U.S. stocks can be a valuable addition to your investment strategy.

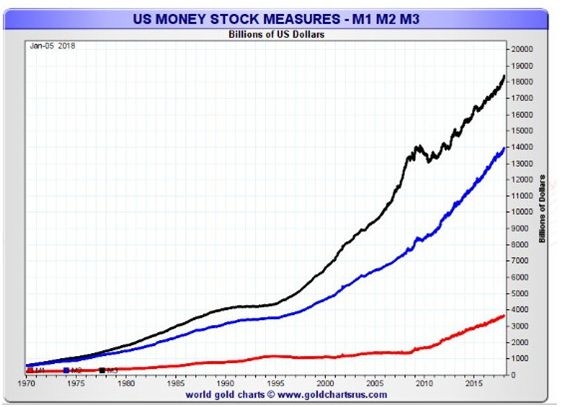

stock levels